Amortization charts are useful tools for individuals and businesses to visualize their loan repayment schedules. These charts provide a detailed breakdown of how each loan payment is applied to the principal balance and interest over time. While many online tools offer amortization calculators, having a printable chart can be handy for quick reference and tracking progress.

Whether you have a mortgage, car loan, or personal loan, an amortization chart can help you stay organized and informed about your financial obligations. By seeing how much of each payment goes towards interest and principal, you can make more informed decisions about your finances and plan for the future.

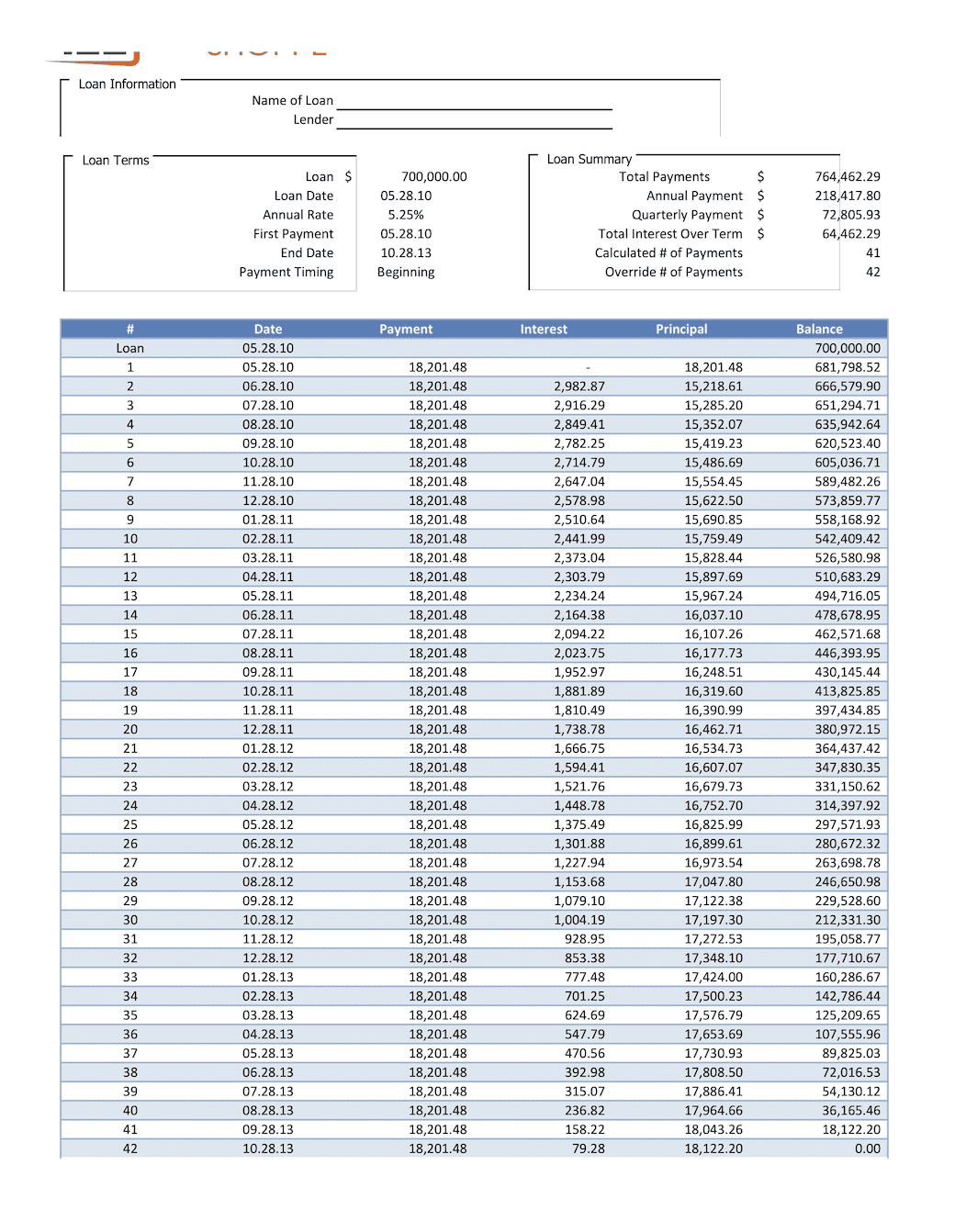

Free Printable Amortization Chart

Free Printable Amortization Chart

How to Use a Free Printable Amortization Chart

When using a free printable amortization chart, it’s important to input accurate information about your loan, including the loan amount, interest rate, term length, and start date. Once you have entered this information, the chart will generate a detailed repayment schedule, showing each payment amount and how it is allocated between principal and interest.

By referring to the amortization chart regularly, you can track your progress in paying off the loan and make adjustments to your budget if needed. You can also use the chart to see how extra payments or changes in interest rates will affect the overall repayment timeline.

Some printable amortization charts also include additional features, such as a breakdown of total interest paid over the life of the loan or a summary of the remaining balance after each payment. These extra details can help you better understand the financial implications of your loan and make informed decisions about your repayment strategy.

In conclusion, having a free printable amortization chart can be a valuable tool for managing your loan repayment schedule and staying on top of your finances. By using this tool, you can track your progress, make informed decisions, and plan for a debt-free future. So, next time you take out a loan, consider using a printable amortization chart to help you stay organized and on track.